Outsourcing accounting allows businesses to cut costs, access expertise, and focus on core activities. This flexible approach lets companies outsource key functions like bookkeeping, payroll, and tax filing. By choosing the right provider, setting clear expectations, and ensuring data security, businesses can enhance compliance and streamline their financial operations.

Finding Financial Management Challenging?

Simplify your accounting and finance with our expert services.

Introduction

Does the idea of juggling spreadsheets, tax filings, and payroll alongside growing your business make your head spin?

If so, you’re not alone.

For many companies, managing accounting in-house becomes overwhelming and costly, especially as they scale.

The good news? You can hand over these complex, time-consuming tasks to experts so you can focus on your vision.

Let’s discuss how to get started, the benefits, and some steps to make outsourcing your accounting a smooth and simple process.

Why Outsource Accounting?

Outsourcing accounting isn’t just about reducing workload but about transforming your business operations.

Here’s what you stand to gain.

- Cost Savings: Outsourcing reduces costs on salaries, benefits, training, and even office space.

- Access to Expertise: You’re hiring experienced accounting professionals with deep knowledge across tax regulations and financial reporting.

- Focus on Core Activities: Outsourcing frees up your time, allowing you and your team to prioritize strategic tasks that drive growth in other areas of the business.

- Enhanced Compliance: With experts handling your accounts, you can stay compliant with local and international regulations effortlessly.

What can you Outsource?

Outsourcing is flexible. You don’t have to hand over everything. You can keep certain functions in-house and outsource the rest, depending on your needs.

Here are a few key functions you might consider outsourcing.

- Bookkeeping and Reconciliation: Regularly recording transactions and reconciling accounts.

- Payroll Processing: Making sure employees are paid on time and in compliance with local laws.

- Accounts Payable and Receivable: Managing payments to vendors and tracking customer payments.

- Tax Preparation and Filing: Handling tax obligations and keeping up with regulations.

- Financial Reporting and Analysis: Generating reports and providing insights to guide business decisions.

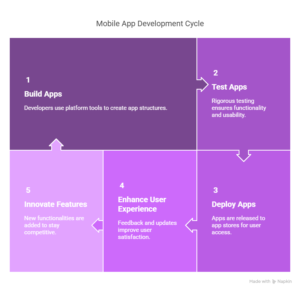

Steps to Outsource Your Accounting

Ready to get started? Here’s a straightforward plan to make outsourcing your accounting as smooth as possible:

1- Define Your Accounting Needs

Start by assessing what tasks you want to outsource. Are you looking for help with payroll only, or do you need comprehensive financial management? This step will help you determine which provider is right for you. List out your specific needs and identify any complex or high-volume tasks that are challenging for your team to handle internally.

2- Choose the Right Service Provider

Not all providers are the same. Look for a partner with a strong reputation, industry experience, and reliable data security measures. You’ll want a provider who understands your industry’s unique challenges and can offer tailored support.

Consider factors such as:

- Experience and Expertise: Do they have experience in your sector?

- Pricing and Flexibility: Can they scale with you as your business grows?

- Communication Style: Are they responsive and easy to reach?

To vet potential providers, ask for references, conduct discovery meetings, and review case studies if available. Some companies even offer trial periods, so you can test their services before committing long-term.

3- Establish Clear Expectations

Define the scope of services in a service-level agreement (SLA) or contract.

This document should outline the following.

- Scope of Work: List all tasks the provider will handle.

- Performance Metrics: Define how you’ll measure success, such as accuracy rates or turnaround times.

- Communication Protocols: Set regular check-ins and reporting schedules to stay aligned.

Being clear from the beginning helps prevent misunderstandings, allowing both you and the provider to maintain a strong working relationship.

4- Prioritize Data Security

Since accounting involves sensitive financial data, security is essential. Make sure your provider has robust data protection measures, such as encryption, multi-factor authentication, and secure data storage.

Only give access to necessary information, and consider using restricted user accounts or secure file-sharing platforms.

You can also include data protection clauses in your SLA to further safeguard your information. Regular security audits are another great way to stay confident in your provider’s data-handling practices.

5- Maintain Regular Communication

Communication is key to a successful outsourcing relationship. Set up regular check-ins to discuss performance, address issues, and review financial reports. This ensures everyone is on the same page and can promptly adjust to any changes in your business or industry regulations.

If your provider works across time zones, consider communication tools that support asynchronous collaboration, allowing both parties to stay informed and engaged.

6- Monitor Performance

Once the relationship is established, track your provider’s performance. Are they meeting the agreed-upon metrics? Are they responsive to feedback? Periodic reviews help make sure you’re getting the desired value. If things aren’t working as expected, don’t hesitate to renegotiate terms or switch providers if necessary.

As your business grows or pivots, your accounting needs might change, and your provider should be flexible enough to adapt alongside you.

Overcoming Common Challenges

Outsourcing accounting is generally beneficial, but it can come with challenges.

- Loss of Control: It’s natural to feel a bit out of control initially. Choose a provider that values transparency and establishes communication protocols.

- Data Security Concerns: Vet providers carefully and make sure they have strong data protection policies in place.

- Adjusting to New Processes: Transitioning can take time. Work closely with your provider during the onboarding period to ease the adjustment.

Conclusion

Outsourcing accounting can be transformative for your business. By reducing costs, improving accuracy, and freeing up your time, outsourcing lets you focus on what you do best: growing your business.

Whether you’re a startup looking to cut overhead or a scaling company needing compliance support, outsourcing accounting can help you take operations to the next level.

So, if you’re ready to let go of the spreadsheets and focus on strategic growth, consider making the switch. Finding the right partner might take some time, but once you do, it’s a decision you won’t regret.